Global security experts dedicated to keeping your data secure

The all-in-one

system to manage

your independent contractors

Onboard, verify and pay your independent contractors (1099 workers, freelancers) efficiently and compliantly. Plus, leverage our platform to manage the details of the work to help ensure timely completion.

Say goodbye to manual processes

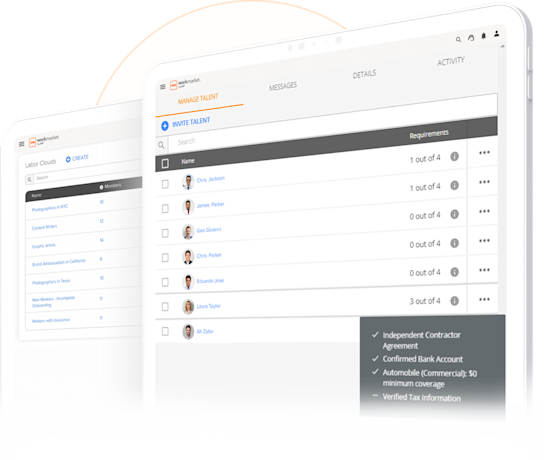

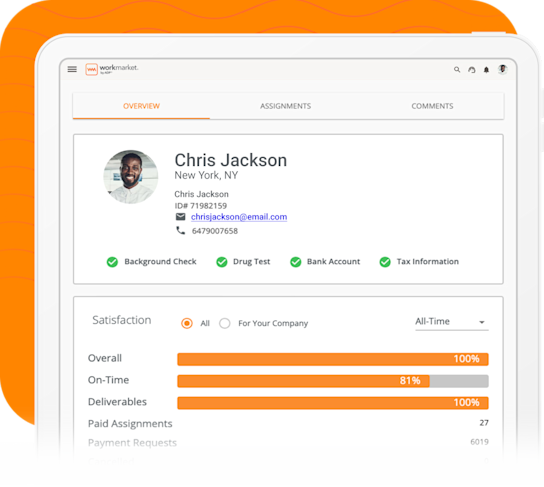

Ensure workers are qualified

We help you to attract talent while streamlining onboarding processes to save you time. With WorkMarket, you can leverage automated guardrails in the verification process to help ensure workers have the right qualifications.

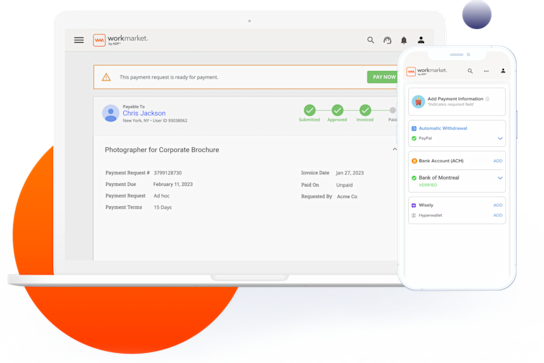

Fast, flexible, and secure payment

WorkMarket enables you to pay your contractors on time, every time, helping you to retain talent. We deliver fast, flexible and scalable payment solutions for your independent contractors in the U.S. and around the globe.

Identify the right contractor for the right work

Engage the right contractor for the right work at the right time. Use Labor Clouds to organize your talent by criteria such as skillsets, geography, background screenings and more so you can deploy contractors quickly.

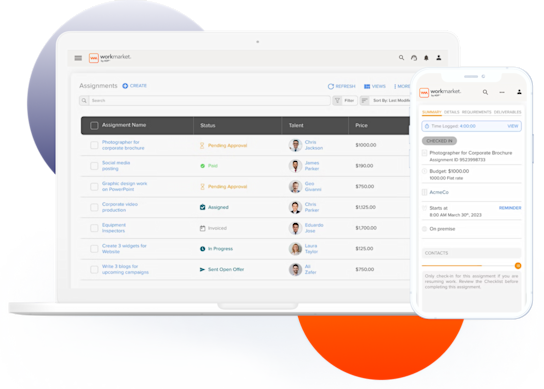

Send and track work at scale

Manage all your work assignments (whether virtual or on-site) from one platform. From sending work to tracking deliverables and a mobile app for on-site work - we've got you covered. Plus, gain a holistic view of all your work assignments so you can easily identify the ones that need your attention.

Get a helping hand on your compliance journey

The regulations around independent contracting are frequently evolving. We help mitigate risk through automated guardrails that help you meet your business requirements. From U.S. tax ID verification to automated invoice generation and electronic 1099-NEC filing, we save you admin time while also providing an audit trail.

Open API to connect your systems

WorkMarket integrates with most of your existing systems, from accounting software to CRM and beyond. We also build custom automation rules based on your unique business needs to help ensure seamless workflows.

The rise of independent contractors: Are you prepared?

Based on a survey of 300 leaders primarily from SMB companies, learn how businesses are planning to leverage independent contractors and their hurdles in building an effective contractor workforce.

Modular or end-to-end solutions

Mix and match to create a solution that works for you

WorkMarket is an end-to-end platform for managing your independent contractors. But our product is also modular. Just need help with onboarding and payments? We’ve got you covered. At WorkMarket, we’ll meet you exactly where you are as your business grows.

Learn how our platform can work for you

What type of contractor do you use?

Health & Wellness Professionals

Creative Service Professionals

Professional Service Consultants

Private Security Professionals

Brand Ambassadors & Influencers

Don't see a category that fits your business? We work with hundreds of companies across a wide range of industries, not just the ones listed here. Our platform can be easily tailored to meet your specific needs.

IT Field Services Marketplace

Connect with thousands of IT field services contractors

Find the right IT professional for your job based on skill sets, certifications, ratings, ZIP codes and more. WorkMarket has an extensive network of field services contractors who can service your white space in geographic coverage or skill sets.

Why WorkMarket

When you partner with us, we’ll enable you to better manage your independent contractors and unlock new possibilities for your business.

Attract top-tier talent

A great onboarding and payment experience for workers

Meet Customer Demand

Quickly identify the right workers for the right jobs

Reduce cost, drive profitability

Automated processes save time and money

Gain visibility into your workforce

Real-time analytics on contractor spend and usage

Improve compliance

Verification of business requirements and filing of 1099-NECs

Scale your business fast

Talent base grows—not administrative burden

See WorkMarket in action

Explore our interactive demo to see how you can leverage automation to manage independent contractors — and virtually eliminate manual processes — from onboarding to pay.

The security and trust you can only get from ADP

Experience designing Human Capital Management (HCM) solutions

Commitment and strength

Two Minute Overview

See how to automate workflows, from onboarding to paying your contractors.

Interactive demo

Click through our self-guided demo to see how you can manage and pay contractors with ease.

Contact Us Today

Learn how our independent contractor management system can be customized for your needs.